For businesses using QuickBooks Online Plus or Advanced, here’s how to get labor costs on a P&L by Job in QBO with Timesheets and QuickBooks Online Payroll. As an added bonus, we’ll make the time entered for each employee billable. Yay!

This post assumes that there is an active QBO Plus or Advanced subscription as well as an active QuickBooks Online Payroll (QBOP) subscription, and that employees, customers and sub customers/jobs are already set up.

NOTE: All time entered here is via the default time entries in QBO. We are not using QuickBooks Time (formerling TSheets) to enter employee’s time.

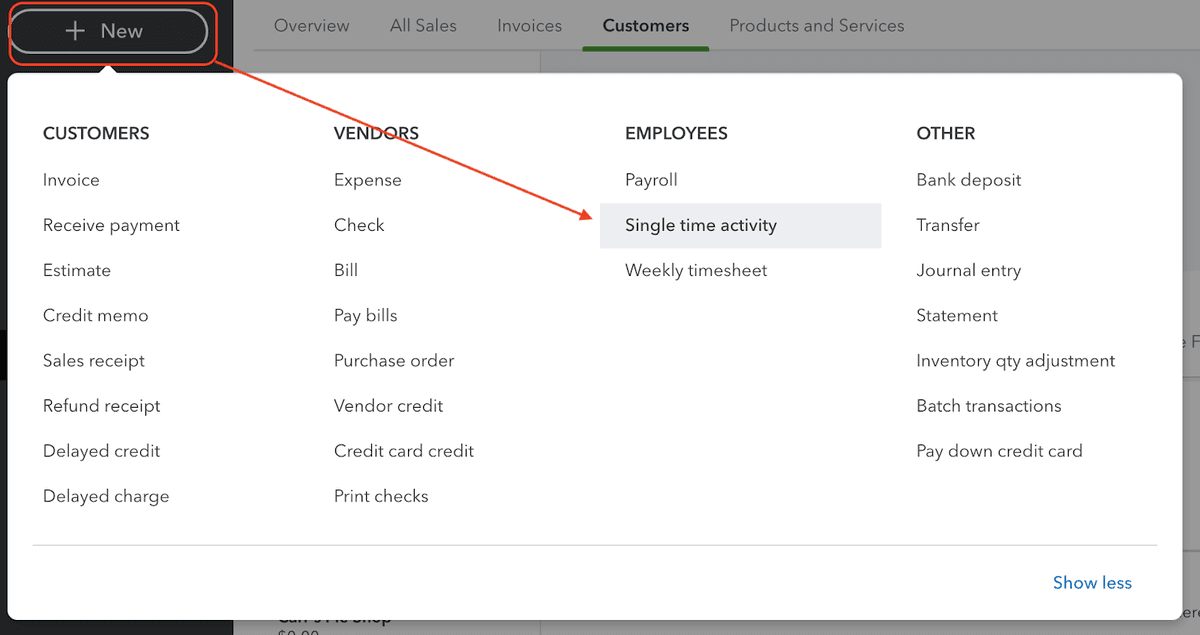

There are two ways to enter time in QBO. One is to click the +New button, then select “Single time activity”:

Below, is time via a single time activity. The employee entered 3 hours and marked them as billable to the customer; this rate can be hidden from Time Tracking Only users. We’ve left Division (location) and Class tracking blank because they’re not applicable to this article. Cost rate would be used for labor costing if Projects was being used and QBOP was NOT being used.

Time can also be entered by clicking the +New button and then choosing “Weekly timesheet”. Below shows time entered for multiple days and multiple sub customers/jobs:

The billable time gets added to invoices:

The time entered via Single time activity and Weekly timesheet flows to payroll, which can be seen by choosing Payroll from the left nav, Employees, then clicking the green “Run Payroll” button:

The Run Payroll screen shows a total of all time entered via time activity and timesheets for the employee; verify then click the green “Preview payroll” button in the bottom right:

Create the paychecks on the next screen by verifying the paycheck details, then clicking the green “Submit payroll” button in the bottom right.

Last, print paystubs and then click the green “Finish payroll” button:

To recap, we’ve entered time, marked it as billable to the customer/job, created the invoice and added time, and run payroll. Now it’s time to look at the P&L by Job in QBO with Timesheets and QuickBooks Online Payroll.

QBO gives us a default P&L by job by going to Reports > Business Overview > Profit and Loss by customer.

P&L by Job in QBO with Timesheets and QuickBooks Online Payroll

With some customization, we can look at what we just did. Click the “Customize” button after the report opens. The screen shot below shows the date range has been changed to “This month” and the Customer field is filtered to show the two sub customers/jobs to which billable time was assigned and invoices created:

Looking at the report, we see the income from the invoices, and the expenses from the wages.

Remember: labor expenses will not show up in a P&L by Job in QBO with Timesheets and QuickBooks Online Payroll until the payroll has been processed and the paycheck created.